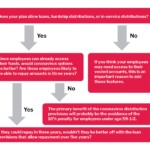

Retirement plan committees are being asked whether to add the coronavirus-related retirement plan distribution and loan provisions to their retirement plans. These committees are under more pressure than usual due to the economic downturn, so in addition to this brief article that should help with the immediate decision-making, it might be worth reviewing this article about a retirement plan committee that acted prudently during a different chaotic economic ... Keep Reading »

Planning to Claim the COVID-19-Related Tax Credits

This article intends to help your payroll or finance departments prepare to take advantage of the employment tax credits provided by the Families First Coronavirus Response Act (FFCRA), signed into law on March 18, 2020. What is the credit? Philosophically speaking, the credit offsets the costs of the emergency paid sick leave and paid FMLA created by the FFCRA. Why are we getting this? The credits should help employers recoup their costs for keeping affected ... Keep Reading »

Retirement and Health Plan Cost Reductions During a Financial Downturn or Recession

Whether the economy is in a financial downturn or your particular organization is hitting a rough patch, at some point you will consider reducing costs. Welfare and retirement benefit expenses generally follow employee compensation, property and infrastructure, and the cost of goods for sale, in terms of significance. The following are some considerations to help you reduce employee benefit costs. Prioritize Your Benefit Structure In general, you want to target benefit ... Keep Reading »

Using Nonqualified Plans to Reduce 401(k)/403(b) Costs

This article focuses on 401(k) and 403(b) plans that are in one of the following situations: The plan failed ADP or ACP testing and must distribute excess amounts to its higher-ranking employees or make additional contributions to its rank-and-file employees. Higher-ranking employees are limiting their salary deferrals in order to avoid triggering top-heavy minimum contribution requirements. The plan must make employee contributions due to its top-heavy status ... Keep Reading »

Four Noteworthy Highlights on the Taxation of Fringe Benefits

This article should interest employers that offer fringe benefits to employees in addition to regular pay. An updated IRS publication outlining how employers should tax certain fringe benefits (IRS Publication 15-B) was released on December 26, 2019. Normally, the changes to Publication 15-B consist of little more than updates to certain statutory limits, like the mileage reimbursement rate, but we noticed several changes that could affect a lot of employers. Following ... Keep Reading »

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- …

- 10

- Next Page »