Retirement plan committees are being asked whether to add the coronavirus-related retirement plan distribution and loan provisions to their retirement plans. These committees are under more pressure than usual due to the economic downturn, so in addition to this brief article that should help with the immediate decision-making, it might be worth reviewing this article about a retirement plan committee that acted prudently during a different chaotic economic time.

Background

The Coronavirus Aid, Relief, and Economic Security (CARES) Act created a coronavirus-related retirement plan distribution and loan option that can be available to certain participants. In general, these are retirement plan participants who would probably be eligible under the emergency paid leave provisions of the Families First Coronavirus Response Act.

The key benefits of the distribution are that it is exempt from early distribution penalties, it can be repaid over three years, and the income tax can be spread over three years. The key benefits of the loan option are that loan repayments are not required in 2020 and participants can borrow greater amounts.

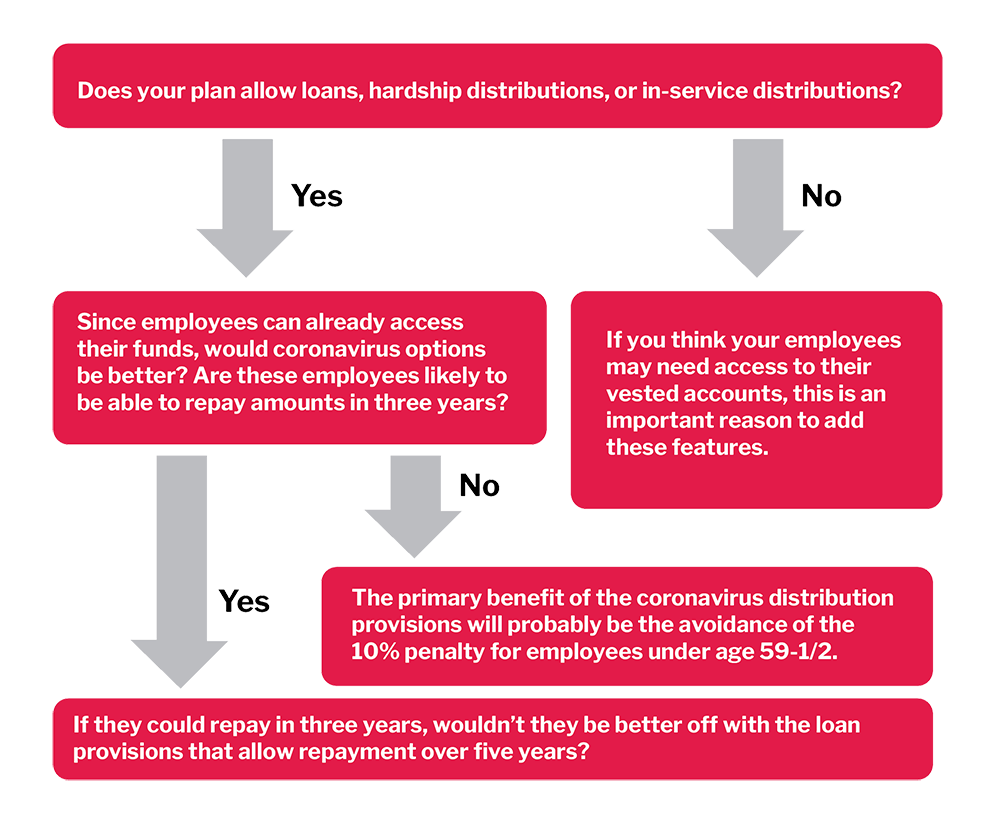

Coronavirus Distribution Feature Decision Tree

Any new retirement plan feature or option is bound to have hidden pitfalls, complexities, and risks of error, but as long as you are comfortable with the people overseeing your plan’s loan program, we do not see an obvious drawback to implementing the loan options. The following is a decision tree to help assess whether the new distribution option should be implemented.

Click here to download and view the decision tree as a PDF.

For more detailed information about employee benefit-related issues, contact the author of this article or the Carlton Fields attorney with whom you normally communicate. More information about the various legal issues surrounding COVID-19 is available at the Carlton Fields Coronavirus Resource Center.